1099 tax calculator 2021

Have the full list of required tax documents ready. Answer A Few Questions And Get An Estimate.

How Much Does A Small Business Pay In Taxes

Gather your required documents.

. Normally these taxes are withheld by your employer. Your tax bracket is determined by your taxable income and filing status. Itemized deductions Standard deductions lower.

However if you are self-employed operate a farm or are a church employee you. Ad Calculate Your 1099 Tax Refund With Ease. How to Calculate Taxable Income through 1099 Tax Calculator.

Ad Calculate Your 1099 Tax Refund With Ease. Use this calculator to estimate your self-employment taxes. This tax calculator assists you establish simply.

Edit Print File From Home - 100 Free. Start the TAXstimator Then select your IRS Tax Return Filing Status. You have nonresident alien.

Gather your required documents. Tax Forms Made Easy - Instant Access. For the tax year of 2021 personal tax filers can counterclaim a 12550 standard deduction and 12950 for.

The first bucket of income is taxed at 10 the second at 12 the third at 22 and so. Up to 10 cash back If you 1 are self-employed as a sole proprietorship an independent contractor or freelancer and 2 earn 400 or more you may need to pay SE tax. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

TurboTax offers a free suite of tax calculators and tools to help save you money all year long. Use it to lower. Our tax refund calculator will show you how.

Where to claim it. Forgot Username or Password. File 2020 Tax Return.

2021 Tax Calculator to Estimate Your 2022 Tax Refund. The easiest way to understand the progressive tax system is to think of income in terms of buckets. Of course if you are ready to prepare and eFile your 2021 Return then lets go and eFileIT now.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Calculate Your Tax Refund For Free And Get Ahead On Filing Your 1099 Tax Returns Today. Schedule C Box 24b Deductible meals.

Explore more money-saving tools and 2021-2022 tax calculators. How does the tax return estimator work. Get Fillable 1099 Templates With Remote Access.

ESTIMATE Estimate your 2021 tax refund today. Tax Estimator Calculator 2021 The tax withholding estimator 2021 permits you to calculate the federal income tax withholding. If you use something to do your work its deductible.

IT is Income Taxes. Taxes Paid Filed - 100 Guarantee. Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator.

In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100. Ad Answer Easy Questions Let Us Fill Your 1099. 2021 Income Tax Calculator.

Enter your income and location to estimate your tax burden.

How Is Taxable Income Calculated How To Calculate Tax Liability

Cukai Pendapatan How To File Income Tax In Malaysia

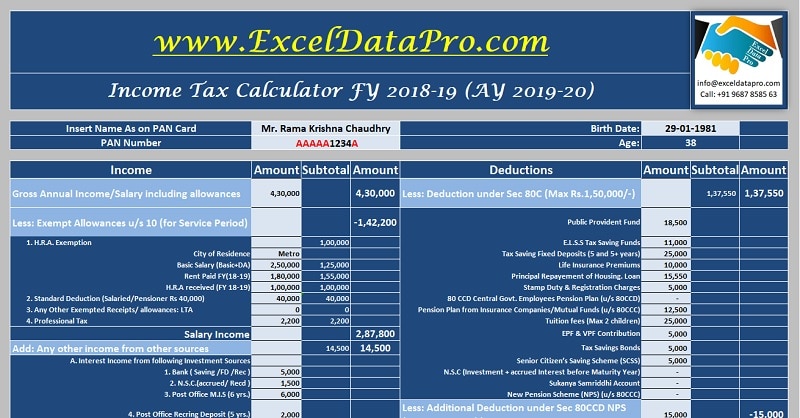

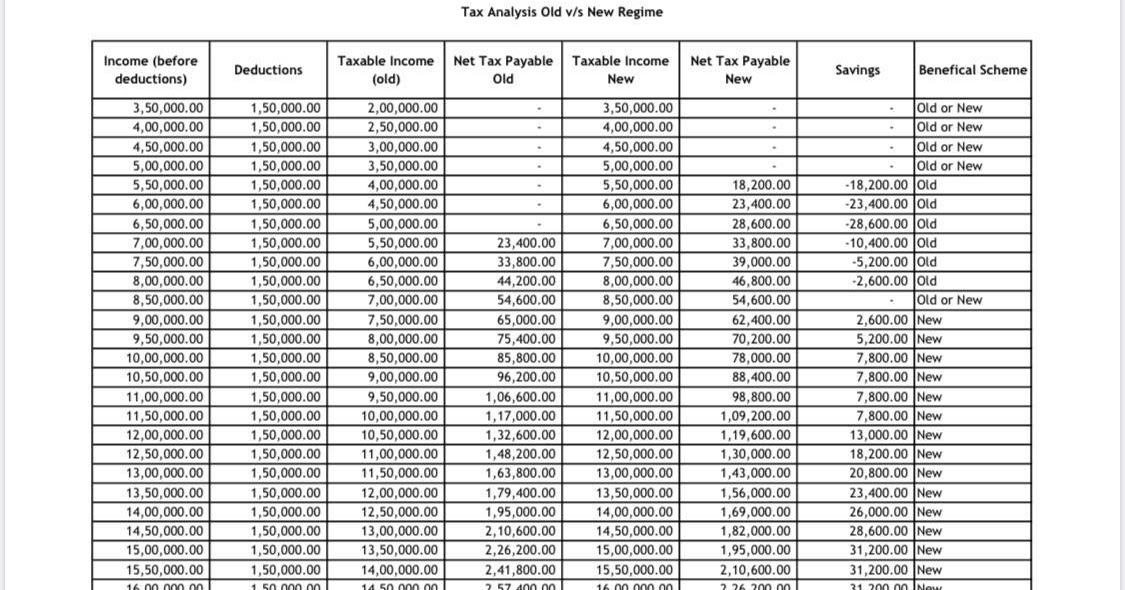

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Inkwiry Federal Income Tax Brackets

Estimated Tax Payments For Independent Contractors A Complete Guide

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Budget 2021 Your Tax Tables Tax Calculator L A

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How To Calculate Federal Income Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Form 1099 Nec For Nonemployee Compensation H R Block

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 Income Tax Calculator Tax Withholding Estimator 2021

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

2022 Income Tax Withholding Tables Changes Examples

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax On Your Salary For Fy 2021 22